When it comes to price action trading, it’s all about observing and interpreting the ebb and flow of the markets. You’re looking for specific patterns that indicate potential trading opportunities.

Let’s break down some of the key patterns you should have on your radar:

Candlestick Patterns: These are your bread and butter in price action trading. Engulfing patterns, pin bars, inside bars, morning/evening stars – they’re all about showcasing the tug-of-war between buyers and sellers. Each of these candlestick patterns tells a story about market sentiment.

Support and Resistance Levels: Spotting areas where price historically has bounced back is key in price action trading. When the price approaches these levels, it’s like hitting a wall. It might break through, or it might bounce back. Observing the price action around these levels can help determine reversals.

Trend Lines: They help you visualize the direction of the market – up, down, or sideways. The price often reacts at these trend lines, making them valuable for identifying potential trading opportunities.

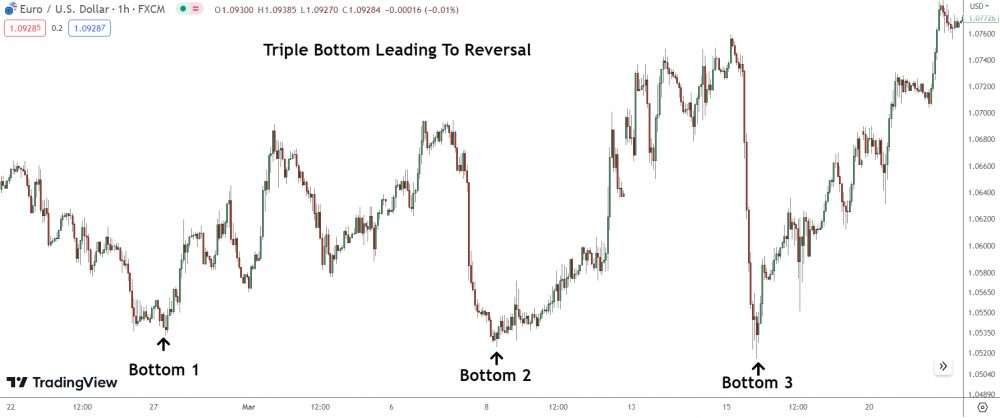

Chart Patterns: These are larger structures like head and shoulders, double tops and bottoms, triangles, wedges, and flags. They’re essentially a series of candlestick patterns that come together to provide a broader view of the market’s direction.

False Breakouts: This is when price briefly crosses a support or resistance level, only to revert back. It’s like a fake-out move that tricks traders into believing there’s going to be a breakout. Spotting a false breakout can provide an excellent trading opportunity.

Reversal Patterns: These indicate that the current trend may be about to change. Reversal patterns could be single candlestick patterns like dojis, or larger structures like double tops and bottoms.

But remember, price action trading isn’t just about spotting patterns – it’s about understanding what they tell you about the market sentiment.

Each pattern tells a story of the battle between buyers and sellers.

Your job is to interpret that story and make informed trading decisions based on it.