I’ve always been a firm believer that the ticket to successful trading lies in having one main trading strategy with several high-probability setups to look for alongside.

These setups may not flash signs as often, but they’ve got a knack for being big winners.

Finding a main strategy?

Piece of cake!

But uncovering those elusive, high-probability setups?

Now that’s like finding a needle in a haystack.

To save you some trouble, I thought I’d share one high probability side setup I usually look for to enter large reversal trades.

Intrigued?

Well, buckle up, ’cause we’re about to dive right in…

The “Secret” Retracement Level Nobody Uses

Welcome to the world of the Fibonacci retracement tool, known far and wide for its four levels, each hinting at potential price reversal points during a retracement:

- The 23.6% level

- The 38.2% level

- The 50% level

- The 61.8% level

These four are like the Beatles of retracement levels. They’re famous, they’re in all the books, and every price action guru can’t seem to shut up about them.

But guess what?

They’re not the only kids on the block…

There’s another “secret” level that’s been flying under the radar, one that isn’t even a part of the fibonacci sequence.

Let me introduce you to… drum roll, please…

The 75% level!

I bet you’re scratching your head right now. The 75% level? Never heard of it! And you know why? Because it’s a not a true fib level, I created it.

Hold on, what?

Why on earth would I make up a level?

Well, the answer is simple: To trade a setup virtually unknown to most traders.

Sounds like a spicy secret, doesn’t it?

Let’s dive deeper…

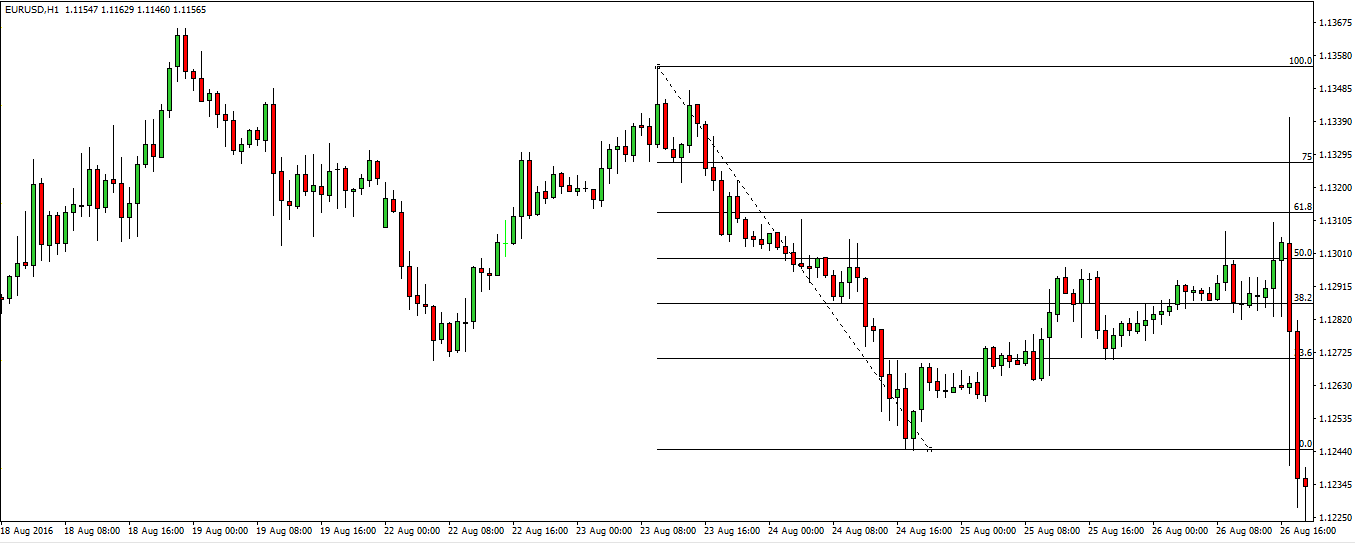

Take a look at this Eur/Usd retracement.

Looks pretty standard, right?

But don’t let its ordinary appearance fool you.

This isn’t your run-of-the-mill retracement – it’s a rare breed, a special type that doesn’t make too many appearances in forex…

See how it moves past the 61.8% level, reversing near the down-swing’s starting point?

This, my friends, is what we call a deep retracement.

Let me explain…

When banks can’t execute all their orders at a single price, they enter what they can, which triggers a price rise or decline. But, here’s the key point: The banks manipulate price back to the vicinity of their initial batch of orders so they can enter their leftovers at roughly the same price.

What we’re left with is the following: a steep rise or fall, followed by another steep move in the opposite direction – hence, the deep retracement.

But what’s the deal with the 75% level, you ask?

Well, deep retracements are often the brainchildren of banks entering large trades or taking significant profits.

These retracements tend to form before major reversals, which means by spotting them (thanks to our trusty 75% level), you can ride some pretty huge reversals with minimal risk.

Pretty cool, right?

I thought you might think so!

How To Trade The Deep Retracement Setup

Trading the deep retracement setup can be easy once you’ve got the hang of it!

Here’s your 5-step game plan for trading the setup:

- Keep your eyes peeled for a steep upswing or downswing.

- Set the retracement on the swing (don’t forget to add the 75% level).

- Jump into a trade using a limit order or price action.

- Plant a stop below or above the swing high or low.

- Take profits as the price moves in your favor.

Alright!

Let’s break down each step for you…

Step 1: Wait For A Sharp Up-Swing Or Downswing

First things first.

The most crucial step is to patiently wait for a steep upswing or downswing to form. Remember, patience is a trader’s best friend!

Deep retracements can happen on all types of swings.

However, the ones which usually lead to large reversals are steep swings – those which consist mostly of large candlesticks with few candles of the opposite type forming.

Here’s what I’m talking about when I say a “steep rise”.

Notice how this rise is dominated by large bullish candlesticks?

Sure, there are a few bearish candles, but they’re merely pint-sized and don’t cause any significant decline to kick in and push price lower.

And here’s how a steep decline should look like.

Again, observe how the decline is primarily made up of large bearish candlesticks (and a gap in this case), with just a few bullish candles which don’t spark any sort of substantial rise during the swing.

Step 2: Place The Fib Retracement On The Steep Rise/Decline

Even though the deep retracement setup isn’t identical to a normal retracement entry, the method used to place the Fib tool on the upswings and downswings is exactly the same:

For steep upswings: Position the tool on the swing low and then drag to the swing high.

As for steep downswings…

For steep downswings: Position the tool on the swing high and then drag down to the swing low.

Got it?

Awesome!

Next up, it’s time to add the 75% level to the fib tool.

The 75% level will help you spot if a retracement really is ‘deep’ and – here’s the fun part – when to dive into a trade!

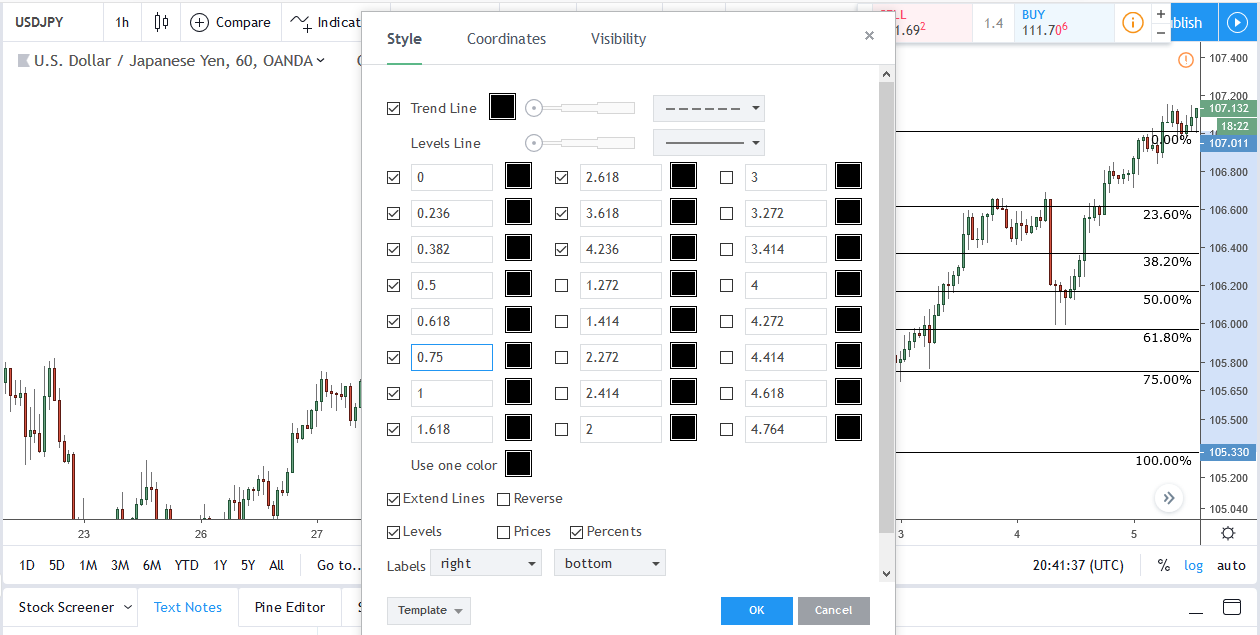

To add this level, right-click on one of the lines and select “Settings”.

Then, in the “Style” box, change the 78.6% retracement to 0.75%.

Success!

The 75% level should now appear on your chart.

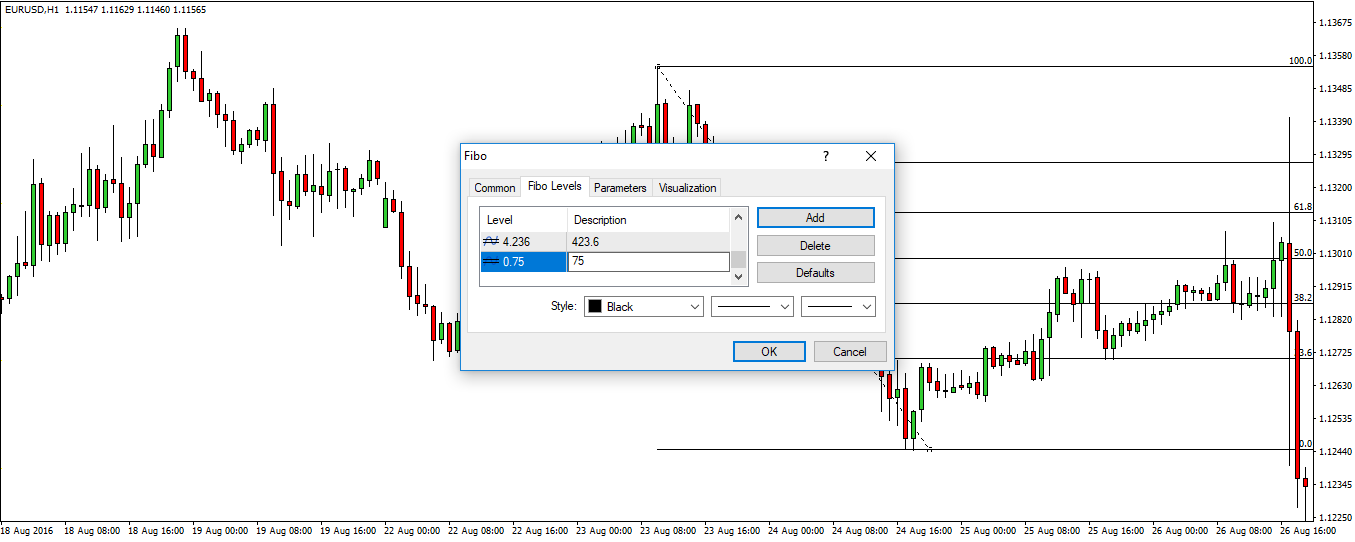

Using MT4/5?

No worries!

Right-click the Fib tool, select “Properties”, and then click “Add”. Enter 0.75 into the “Level” box, and then enter 75 in the “Description” box.

And there you have it, the 75% level is ready to roll!

Step 3: Enter Using Price Action Or Limit Order

There are two main ways to trade the deep retracement setup. Each comes with its own perks and pitfalls, so you can choose what suits your style best.

First up, you can dive in using price action.

Want a extra confidence a reversal is on the horizon?

This is the way to go!

Wait for the price to hit the 75% level, then make your move when you spot a bullish or bearish engulfing pattern or pin bar candlestick forming.

Sounds easy, right?

But here’s the catch…

A pattern won’t always form when the price hits the 75% level, so you may sometimes miss out on successful trades.

But hey, that’s the game!

Your other option is to dive in via a limit or pending order.

All you need to do is place a limit order at the 75% level.

The downside?

Sometimes a deep retracement won’t happen, and price might just break through the swing low (or high, for downswings), leaving you with a losing trade.

Ouch!

Step 4: Place A Stop Loss

No matter how you decide to enter, always – and I mean always – place your stop loss either above or below the swing high or low of the swing.

For deep retracements on downswings, place the stop above the high.

For upswings, place it below the low.

A word to the wise: Leave a small gap between the swing low/high and your stop loss to dodge any sneaky stop hunts that might occur before price reverses.

Got all that?

Excellent!

Step: 5: Take Profits As The Price Rises/Falls

So, you’ve managed to snag a deep retracement trade?

Excellent!

But remember, this is just the beginning.

Now, it’s all about managing your stop.

Every time a new swing low or high forms, move your stop to the end of the deep retracement swing.

Why, you ask?

Because this will dramatically slash your risk.

If price suddenly decides to reverse, you’ll be left with only a tiny loss.

Smart, right?

But hey, don’t get ahead of yourself!

Timing is everything here.

Make sure you only move the stop to the deep retracement swing AFTER price has made its way back to the halfway mark of the previous swing.

Wondering how to do that?

Just whip out your fib tool, slap it on the swing and see if the price is at or above the 50% level.

The Bottom Line

So, there you have it!

In a nutshell, the deep retracement setup can spice up any trading strategy.

Sure, it might not appear as often as other trading signals, but when it does, it’s worth a punt. It carries a high probability of working out and offers you a ticket to some seriously big reversal trades.

Now, isn’t that something to get excited about?

Happy trading, folks!