The first clue is the the size of their trades.

Smart money tends to make larger trades that can influence the market, while retail traders are typically making smaller trades that don’t have little to no impact.

Another key difference is in how they behave.

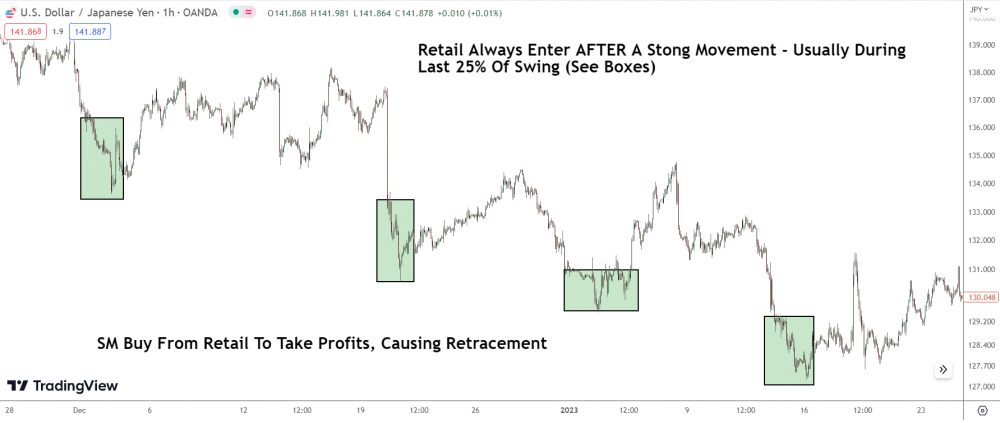

Retail traders often chase trends, buying when prices are high and selling when they’re low. It’s like they’re always a step behind.

On the other hand, smart money often moves ahead of the curve.

They buy low and sell high, setting the trends that others follow.

But here’s the secret: Smart money tends to leave footprints in the form of market patterns and trends. They might use strategies to hide their moves, but there are often signs—like sudden price movements or changes in volume.

These are your clues to identifying smart money in action.

Just remember, it’s not about trying to beat the smart money. It’s about understanding their moves so you can make smarter decisions.

Keep your eyes open and stay flexible.