When we talk about trading, liquidity is king.

It’s like the lifeblood of the market.

But what is liquidity?

In short: it’s the ease with which an asset, or security, can be bought or sold without affecting its price. A market is considered highly liquid if there are enough participants trading that large transactions won’t drastically sway the price.

Now, let’s bring ‘smart money’ into the mix.

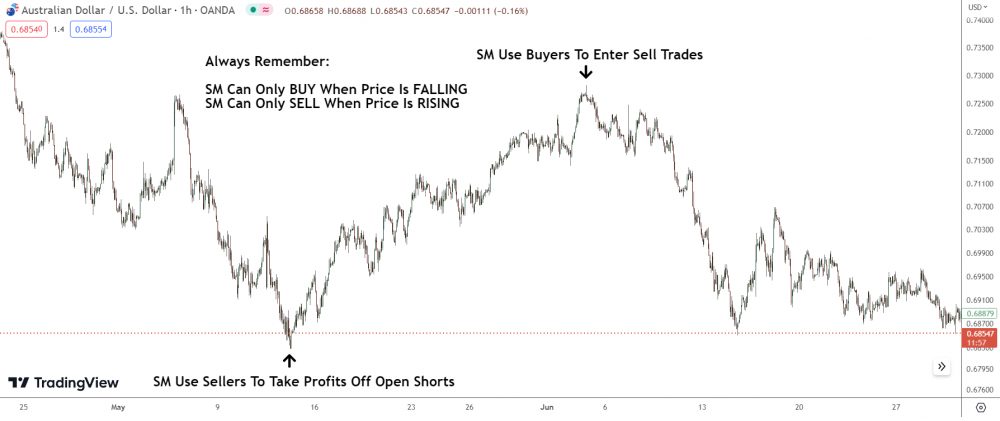

Remember, ‘smart money’ need massive volumes in order to buy or sell effectively.

When few buyers or sellers are around, the smart money can’t enter any major postions – not enough volume exists. Hence, they must operate during high liquidity times. In the case of forex, that’s during the trading sessions which best represents the two currencies being traded.

Furthermore, highly liquid markets allow these big players to hide their tracks.

They can split their orders into smaller chunks, spreading them out over time to prevent their actions from overly influencing the market. This way, they get to move their money without the market moving against them.

In summary, liquidity is critical to smart money trading.

It allows for large transactions without significantly affecting price, makes it easier to enter or exit positions, and helps mask the movements of these large players.